Key components of the debt management policies ensure that:

- combined net direct debt does not exceed 3% of taxable assessed value;

- at least 40% of the overall debt is repaid within five years and 70% within ten years;

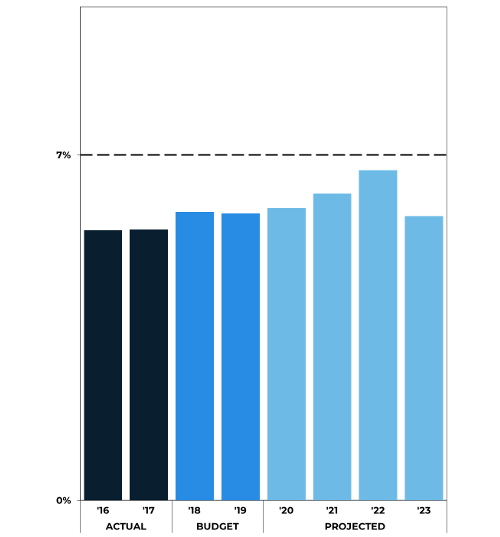

- annual gross debt service costs do not exceed 7% of general fund expenditures; and

- variable rate debt does not exceed 20% of the City’s total currently outstanding bonded debt (the City has no variable debt).

For further discussion of the City’s financial policies and management controls, refer to the pdf chapter (Volume I) on Financial Management.

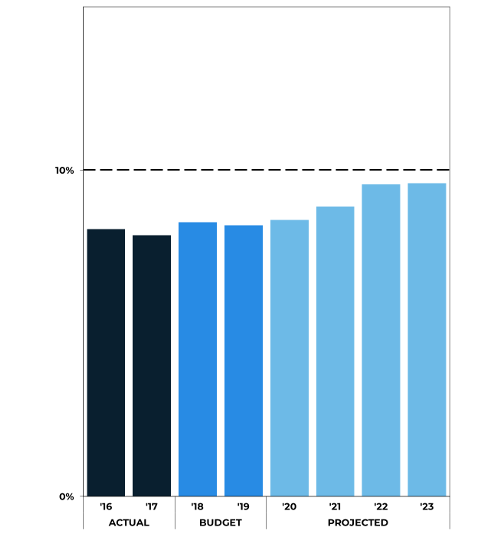

The City’s debt service forecast assumes general obligation borrowing of $177 million in FY19, $203 million in FY20, $220 million in FY21, $215 million in FY22, and $200 million in FY23.

The debt tables at the end of the pdf chapter (Volume I) on Capital Planning detail the City’s outstanding debt service obligations.